买入看涨期权使投资者在资产价格上涨时获得利润,同时涉及的风险最小。在本文中,我们解释了买入看涨期权的基本原理、如何交易、它的优缺点,以及投资者如何利用这一工具提高收益。

看涨期权是一种金融合约,赋予持有者在特定期限内、按预先设定的行权价买入标的资产的权利(而非义务)。标的资产类型多样,可涵盖股票、大宗商品、债券、外汇、指数等。 与普通股票或股份不同,投资者在购买期权时只需支付较少的初始费用,而无需一次性支付全部金额。例如,若你想购买每股价格为50美元的100股股票,通常需要支付5000美元。 相比之下,买入看涨期权仅需支付标的资产价值的一小部分——即权利金。例如:若该股票看涨期权的权利金为每股2美元,则支付200美元即可获得以行权价买入100股的权利。 这笔初始资金将支付给看涨期权卖方。若买方选择行权,卖方有义务履行交割。这种策略被称为卖出看涨期权。另外,请注意,双方都可以选择终止合同。 买入看涨期权特指期权买方的持仓头寸。当投资者购买看涨期权时,即建立"多头"头寸。这是一种看涨策略,因为只有当标的资产价格超过行权价与权利金之和时,买方才能获利。什么是买入看涨期权?

买入看涨期权的关键组成部分包括: 与买入看涨期权相关的其他基本概念包括:买入看涨期权的关键组成部分

Leverage. One advantage of call options is that they allow investors to control large contract values with just a small initial capital, making them lucrative as they can make huge profits from leverage. Limited risk. The call option has a defined risk-to-reward ratio, which helps buyers control the possibility of loss. Flexibility. In option trading, investors are in a position to select various expiration prices for the contract. Thus, an investor can tailor their strategy to meet the market outlook anytime. Profit potential. If an investor has made a correct decision, they can gain significant profits, especially in cases of high volatility where the underlying asset appreciates substantially.Advantages

In some cases, the contract may result in a full loss of the initial amount of premium paid. Compared with other assets, such as currencies, the option does not yield a one-for-one profit with the underlying. In some cases, the underlying asset may only yield $0.7 for a $1 move because of the delta. Delta is a key number in options trading. It tells you how much an option's price changes when the underlying asset, like a stock, moves by $1. It shows how sensitive the option is to price movements. For example, if a call option has a delta of 0.2 and the stock goes up by $1, the option's price should rise by about $0.20. Delta changes over time. Early in the option's life, or when the option is far out-of-the-money, delta tends to be low because the chance of the option becoming profitable is smaller.Disadvantages

Here, we'll explain the differences between the call option and other trading strategies. Long call option vs. buying stocks. Investors require less capital to initiate a long-call contract than to buy stock or shares. This reduces the risk involved in cases where the contract does not profit. Moreover, an investor trading in the stock market or investing in shares is not bound by time, as in the case of option trading. Long call option vs. short call option. Short put options allow investors to buy the underlying asset at a certain agreed-upon price (strike price). Similarly, sellers get a premium as compensation for the obligation. The option expires or loses its value if the price exceeds the strike price. However, an investor must understand that the seller's profit is restricted to the agreed-upon initial payment.Long call vs. other strategies

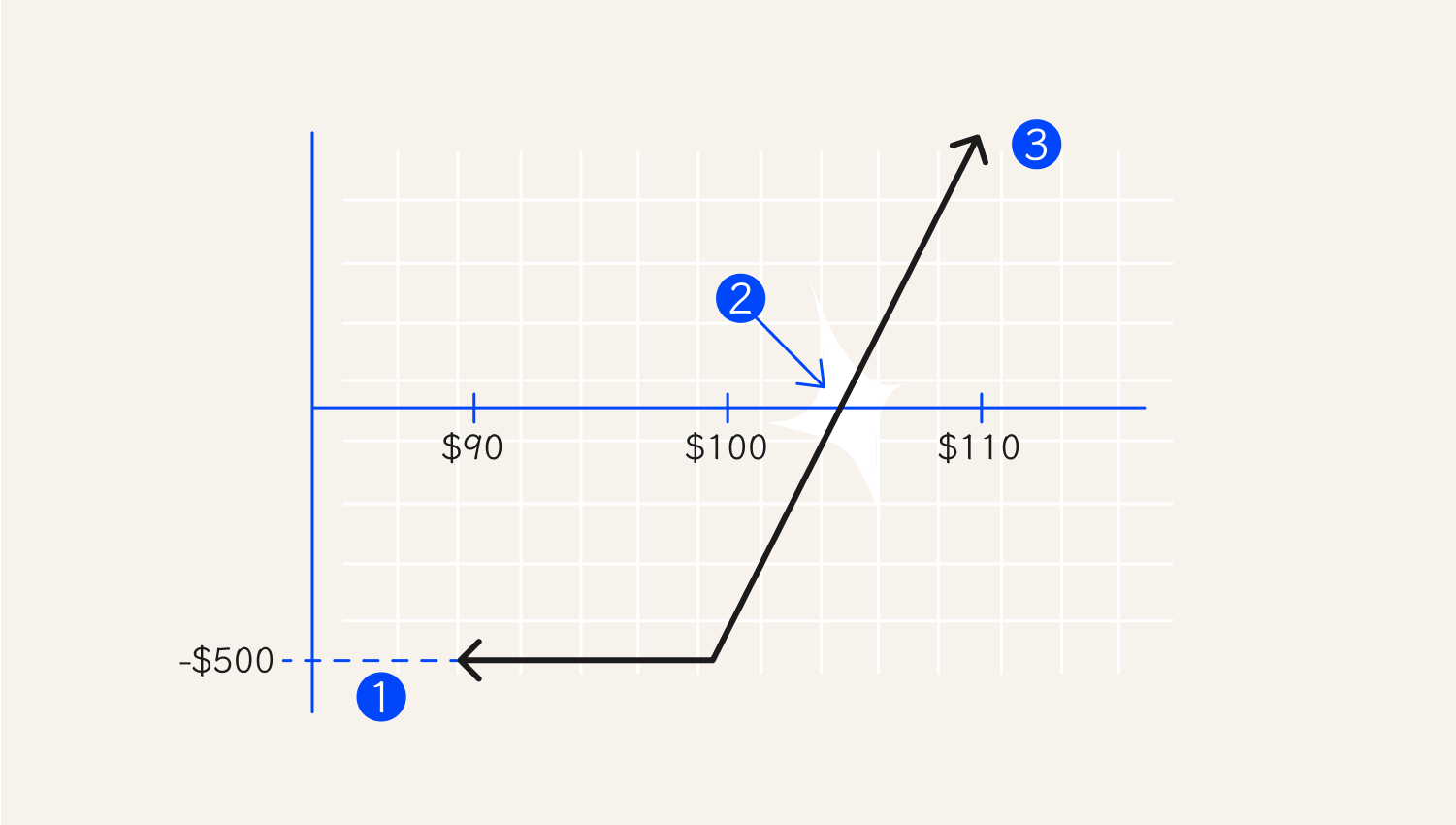

The diagram below explains the long call option. First, investors should note that the maximum risk is capped at the option's cost. Thus, the potential gain and profit potential are unlimited. Second, for an investor to make money, the underlying stock price should be higher than the strike price at the expiration point. In the example below, a long call option with a strike price of $100 purchased for $5 has a potential loss of $500 and unlimited gain only if the price continues to rise. It is essential to understand that the underlying price must be higher than $105 at expiration for the investor to make money.Examples

1. Maximum loss

2. Breakeven: $105

3. Maximum profit is unlimited

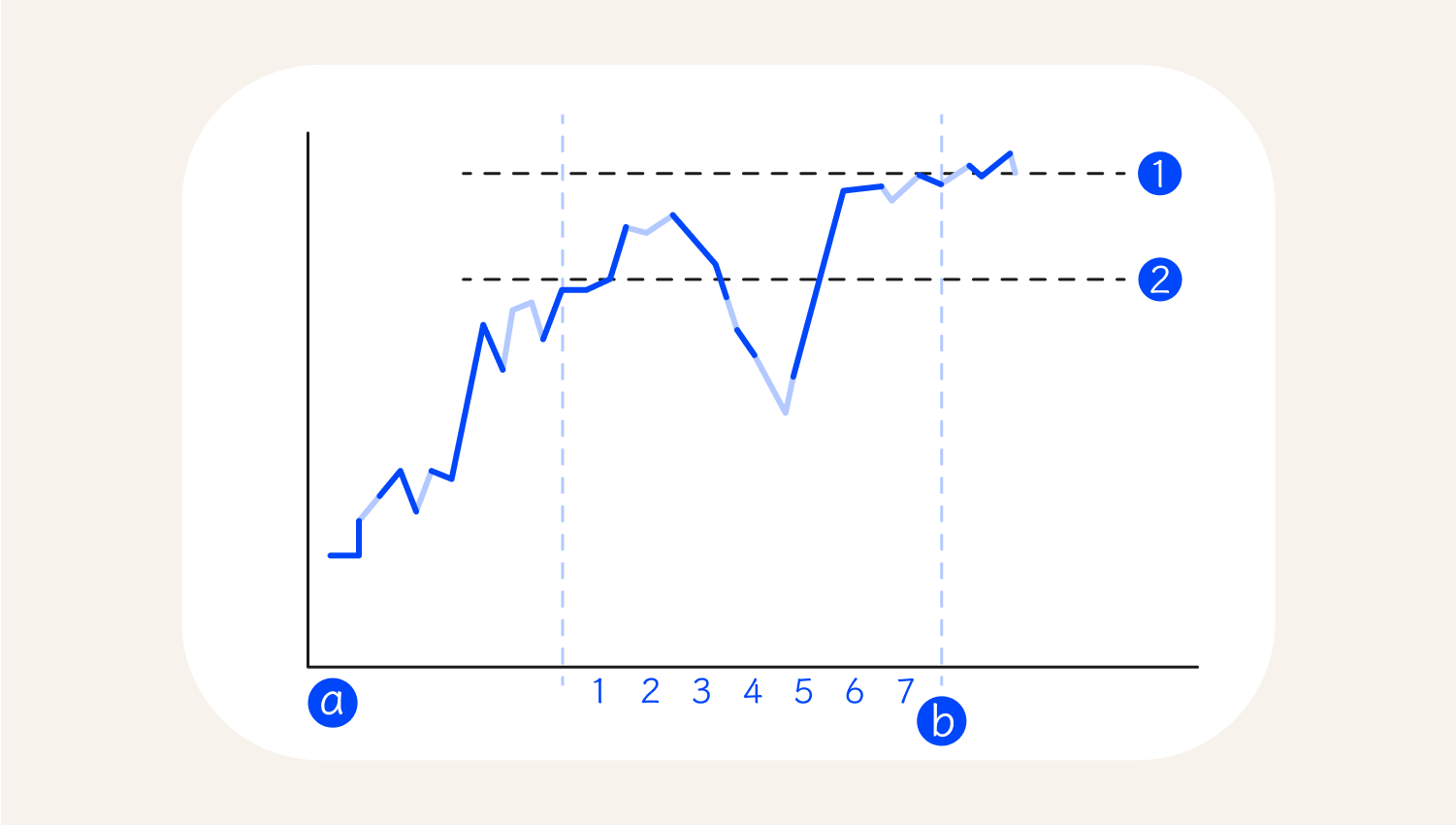

Using a long call option involves buying a call option when you expect the price of the underlying asset to rise. Here's how to use this strategy effectively:How to use the long call option

1. Profit

2. Strike price

a. Days

b. Option expiry date

Start small. If you are new to options trading, it is wise to start small, as this will give you time to understand the market and gain experience. Also, always remember that trading is risky—do not invest more than you are ready to lose. Use technical analysis. For decades, all investors have used technical indicators to identify potential areas of entry and exit. Besides, in technical analysis, you can add chart patterns, such as harmonics and candlestick patterns, to improve your strategy. Stay informed. Good investors are constantly updated on the fundamentals that impact the market. Thus, select blogs or channels that will keep you updated with news like earnings reports, consumer price indexes, and other essential factors that significantly impact your chosen assets. Diversify your portfolio. Do not put all your capital in one asset. Creating a portfolio will help you succeed since the unprofitable positions will be offset by others.How to increase the possibility of success

Final thoughts