Back

29 Mar 2023

Crude Oil Futures: Upside momentum could take a breather

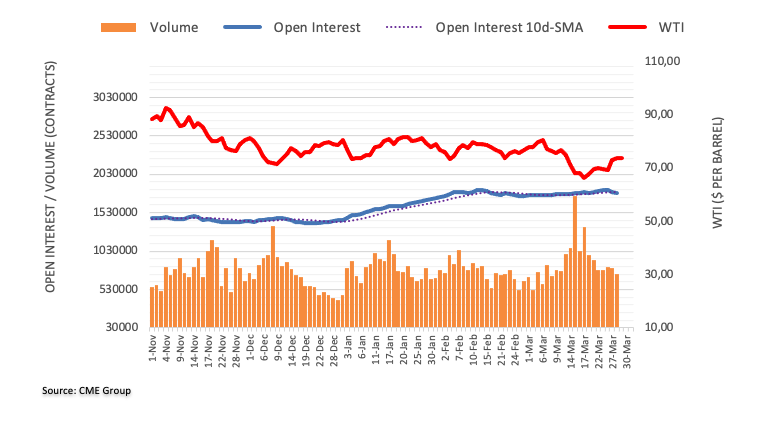

Open interest in crude oil futures markets shrank for the second session in a row on Tuesday, now by around 11.5K contracts according to preliminary readings from CME Group. In the same line, volume went down for the second straight day, this time by nearly 69K contracts.

WTI faces the next hurdle at the 55-day SMA

Prices of the WTI extended the weekly leg higher on Tuesday and close above the $73.00 mark per barrel. The positive price action, however, was in tandem with declining open interest and volume and signals that the current bull run could struggle to advance further in the very near term at least. On the upside, the 55-day SMA near $76.20 should offer initial resistance.