Back

30 Mar 2023

Crude Oil Futures: Extra decline in store

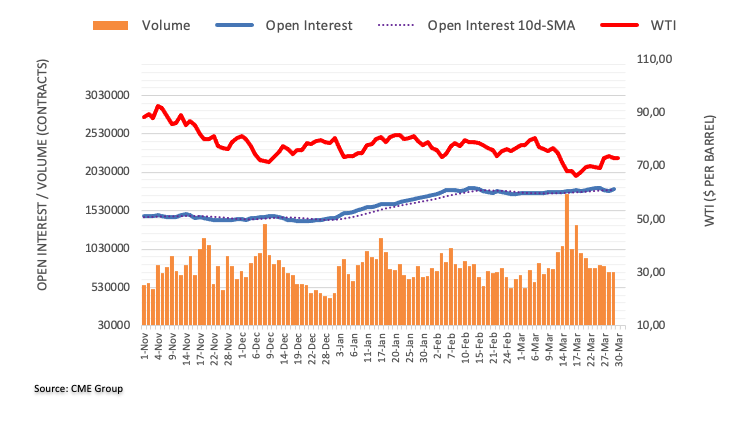

Considering advanced prints from CME Group for crude oil futures markets, open interest reversed two daily drops in a row and went up by around 21.8K contracts on Wednesday. Volume, instead, extended the downtrend for the third consecutive day, this time by nearly 8K contracts.

WTI: Gains appear capped by $74.00… for now

Prices of the WTI printed new weekly highs, although it ended Wednesday’s session in the negative territory. The downtick was in tandem with increasing open interest and suggests that extra losses may be in store for the commodity in the very near term. In the meantime, the recent peak past the $74.00 mark per barrel (March 29) emerges as the next hurdle of note.