Back

23 Oct 2023

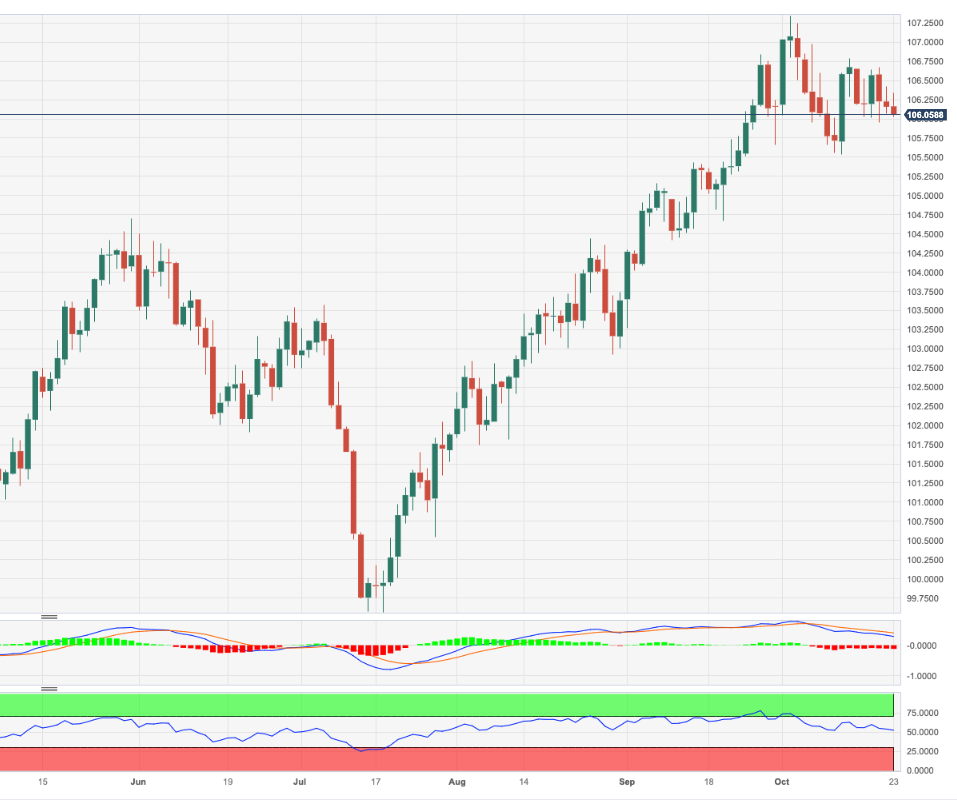

USD Index Price Analysis: No changes to the consolidative phase

- DXY adds to the ongoing downtrend on Monday.

- Gains appear so far limited around the 106.80 zone.

DXY extends the negative price action and challenges once again the key 106.00 neighbourhood at the beginning of the week.

It seems the index keeps trading within a consolidative phase for the time being. Occasional bullish attempts, in the meantime, continue to target the weekly high of 106.78 (October 12) prior to the 2023 top of 107.34 (October 3).

So far, while above the key 200-day SMA, today at 103.31, the outlook for the index is expected to remain constructive.

DXY daily chart