Back

21 Dec 2023

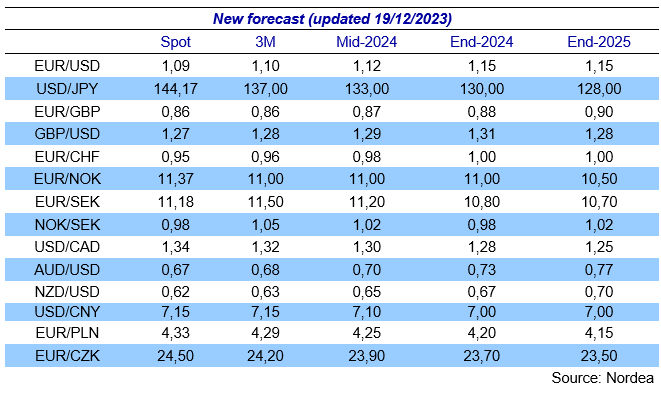

EUR/USD to rise in the year to come – Nordea

Economists at Nordea expect risk-sensitive FX to benefit in 2024 with the EUR/USD pair also gaining ground.

Weaker USD due to a dovish Fed

We expect EUR/USD to rise in the year to come.

Faster rate cuts in the US than elsewhere point to more Dollar weakening. The US rate cuts should also underpin the global economy, commodity and energy prices and risk sentiment. Thus, risk sensitive currencies, such as NOK and SEK, should fare better in the time to come. However, there are numerous risks on the horizon including potential government debt troubles, the US Presidential election and geopolitical challenges. Many of these could send the USD stronger than we have pencilled in.

We do expect the high volatility in the FX market to continue in the year to come.