WTI rallies to $43.60, session tops

Crude oil prices are extending the rebound seen during the second half of last week, now lifting the barrel of West Texas Intermediate to the $43.60 region, up more than 1%.

WTI keeps the bear market intact

Despite the ongoing rebound from 7-month lows in the $42.00 neighbourhood (Wednesday), crude oil prices remain under heavy pressure as concerns over the supply glut appear everything but abated.

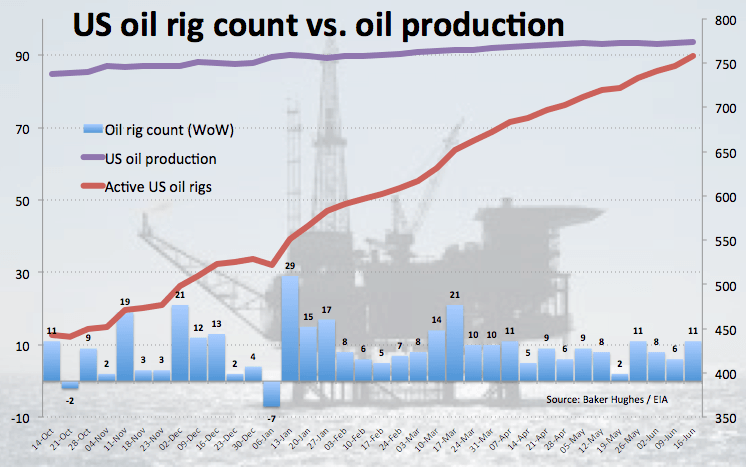

Adding to the already deteriorated panorama around crude oil, US active oil rigs kept increasing during the last week according to Friday’s report by driller Baker Hughes. This time, US oil rig count went up by 11 to 758 US active oil rigs, advancing for the 23rd consecutive week.

Traders remain wary of the rising US oil production and other oil-producer countries such as Iraq and Libya (not included in the OPEC deal), while skepticism around the effectiveness of the OPEC agreement to re-balance the oil market keeps running high.

Later in the week, report on US crude supplies by the API (Tuesday) and the EIA (Wednesday) are expected.

From the positioning front, crude oil speculative net longs have retreated to 6-week lows in the week to June 20, according to the latest CFTC report.

WTI levels to consider

At the moment the barrel of WTI is up 1.33% at $43.58 and a break above $44.40 (23.6% Fibo of the May-June drop) would aim for $45.06 (high Jun.19) and then $45.63 (20-day sma). On the flip side, the support aligns at $42.05 (2017 low Jun.21) followed by $41.10 (low Aug.11 2016) and finally $39.19 (low Aug.3 2016).