WTI pushes higher around $62.00

- WTI rose to $62.40 in early trade.

- Risk-on recovery helps the upside.

- Oil stronger on geopolitical jitters.

The barrel of the American reference for the sweet light crude oil is extending the upside momentum this week around/above the key $62.00 mark.

WTI propped up by geopolitical concerns

Prices of the barrel of West Texas Intermediate are up for the fourth session in a row on Monday, advancing beyond the critical $62.00 mark or around $4 since last week’s lows in the $58.00 neighbourhood.

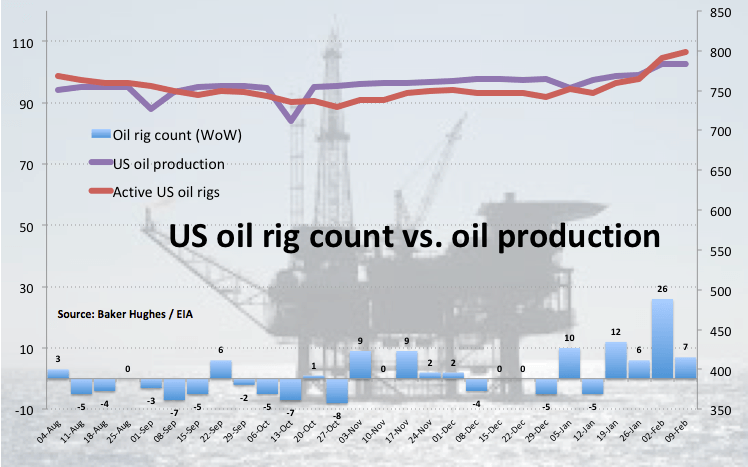

WTI keeps advancing in spite the of increasing US oil output, rising supplies and another uptick in US oil rig count by Baker Hughes, this time taking US active oil rigs to nearly 800 during last week, the highest level since April 2015.

Instead, the current recovery in crude oil prices appear to have found fresh oxygen in the recent developments involving Syria, Israel and Iran, fanning the flames for potential supply disruptions.

From the speculative community, crude oil net longs were trimmed to 4-week lows in the week to February 13, according to the latest CFTC report.

WTI significant levels

At the moment the barrel of WTI is gaining 0.76% at $62.02 facing the next hurdle at $62.39 (high Feb.19) seconded by $62.53 (50% Fibo of $55.74-$66.72) and finally $63.09 (21-day sma). On the flip side, a breach of $60.99 (10-day sma) would open the door to $59.93 (61.8% Fibo of $55.74-$66.72) and finally $58.10 (low Feb.9).