Back

16 May 2018

US 10-year yield rises to 7-year high, what's next?

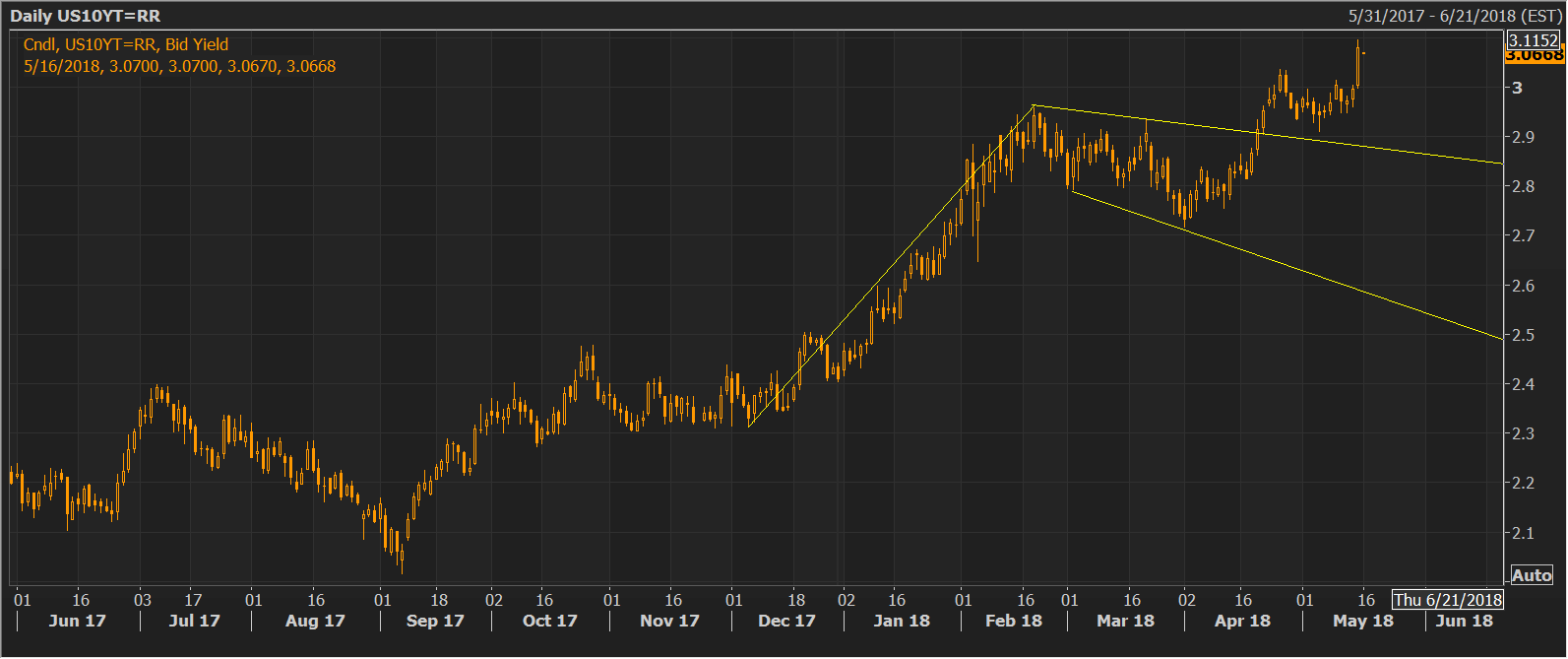

- The US 10-year treasury yield rose to a 7-year high of 3.095 percent.

- The yield could rise to 3.5 percent this year, the technical charts indicate.

The yield on the benchmark 10-year treasury note finally cut through the resistance at 3.04 percent and rose to 3.095 percent yesterday - the highest level since 2011 and the technical charts indicate the party has just begun.

The bull flag breakout, a bullish continuation pattern, confirmed in mid-April (seen in daily chart) indicates scope for a rally to 3.5 percent.

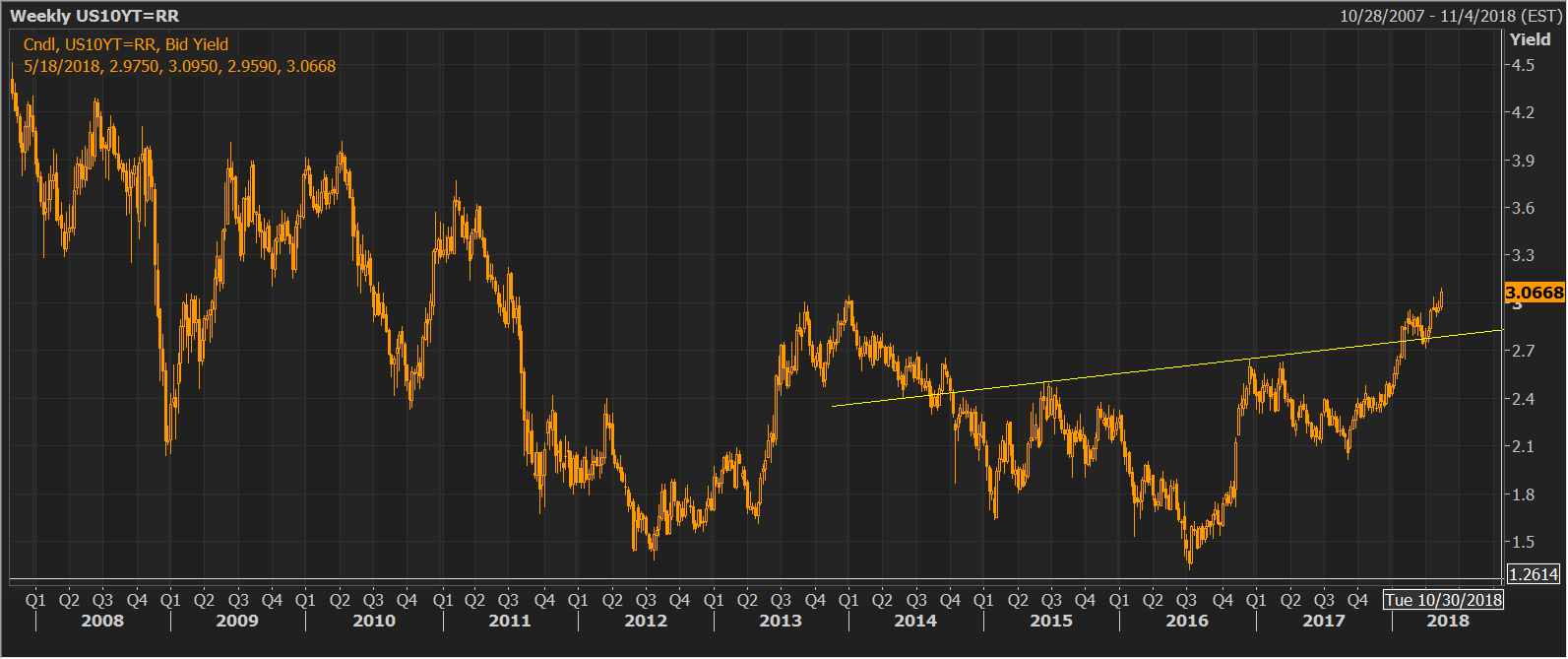

The bullish setup in the daily chart only adds credence to the long-run bearish-to-bullish trend change, as highlighted by the inverse head-and-shoulders breakout on the weekly chart.

Clearly, the 10-year yield looks set to rise in the USD-positive manner in the near future. As of writing, the yield is trading at 3.07 percent.

Daily chart

Weekly chart