Back

19 Feb 2019

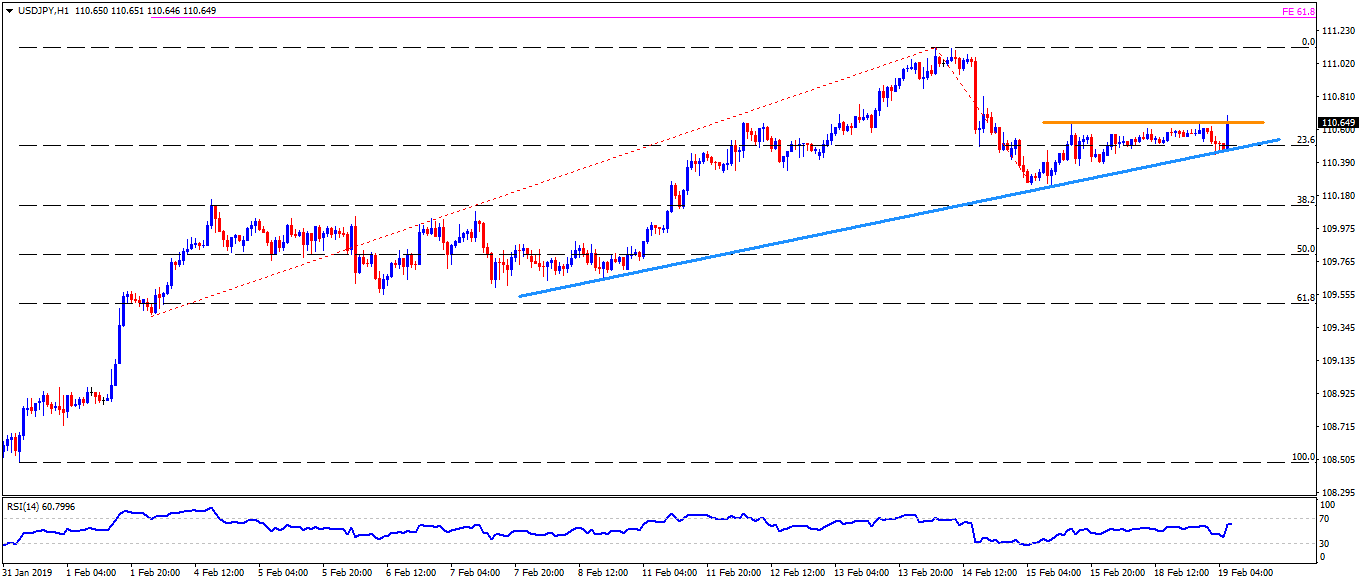

USD/JPY Technical Analysis: Decisive break of 110.65 can reprint 110.90 and 111.15 as quotes

- USD/JPY trades around 110.65 as markets rush to European open on Tuesday.

- The pair recently ticked up to 110.70 but failed to sustain the upside.

- A successful break above 110.65 horizontal-line including the highs marked on Friday and Monday can escalate the pair’s up-move to 110.90 and then to the February month high of 111.15.

- During the pair’s extended rise past-111.15, 61.8% Fibonacci retracement of its early-month trading pattern, at 111.30, may please buyers.

- On the downside, an upward sloping trend-line at 110.45 can limit the pair’s adjacent declines.

- Should the quote slips under 110.45, 110.25 and 110.00 may regain sellers’ attention.

USD/JPY hourly chart

USD/JPY

Overview:

Today Last Price: 110.66

Today Daily change: 0.07 pips

Today Daily change %: 0.06%

Today Daily Open: 110.59

Trends:

Daily SMA20: 109.86

Daily SMA50: 110.12

Daily SMA100: 111.58

Daily SMA200: 111.31

Levels:

Previous Daily High: 110.62

Previous Daily Low: 110.42

Previous Weekly High: 111.13

Previous Weekly Low: 109.7

Previous Monthly High: 110

Previous Monthly Low: 104.75

Daily Fibonacci 38.2%: 110.54

Daily Fibonacci 61.8%: 110.5

Daily Pivot Point S1: 110.47

Daily Pivot Point S2: 110.35

Daily Pivot Point S3: 110.28

Daily Pivot Point R1: 110.66

Daily Pivot Point R2: 110.73

Daily Pivot Point R3: 110.85