Back

25 Nov 2019

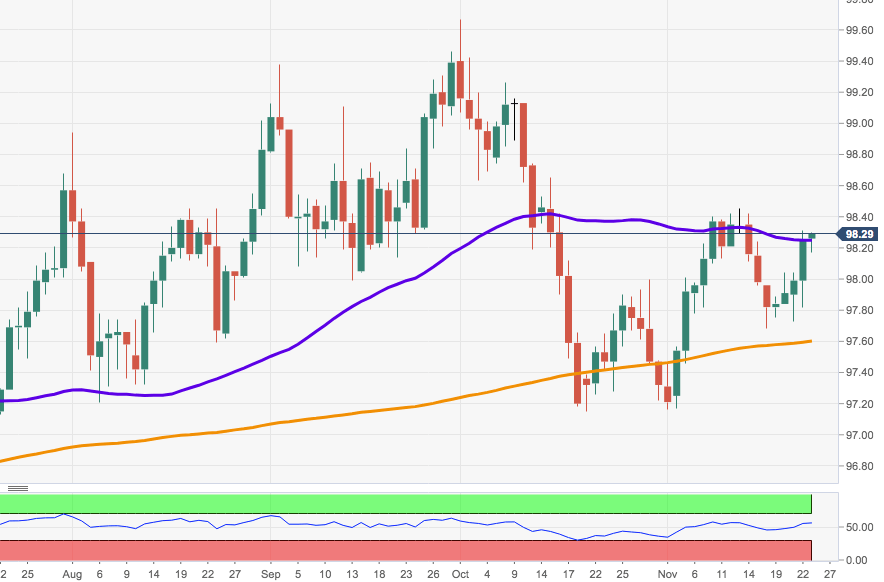

US Dollar Index Technical Analysis: Keeps the recovery in place. Targets the 98.50 region.

- The recovery in DXY remains well and sound above the 98.00 mark.

- Immediately above aligns the monthly peaks in the mid-98.00s.

The index is now flirting with the 55-day SMA in the 98.20/30 band, extending at the same time the positive streak for the fifth session.

Further upside impetus should now target monthly tops in the 98.50 region. A sustainable break of this hurdle should pave the way for a move to the 99.00 hurdle and potentially beyond.

In the meantime, as long as the 200-day SMA at 97.58 holds the downside, the constructive outlook on the buck remains unchanged.