AUD/USD Price Analysis: Bullish channel in tact, (RBA on hold sentiment)

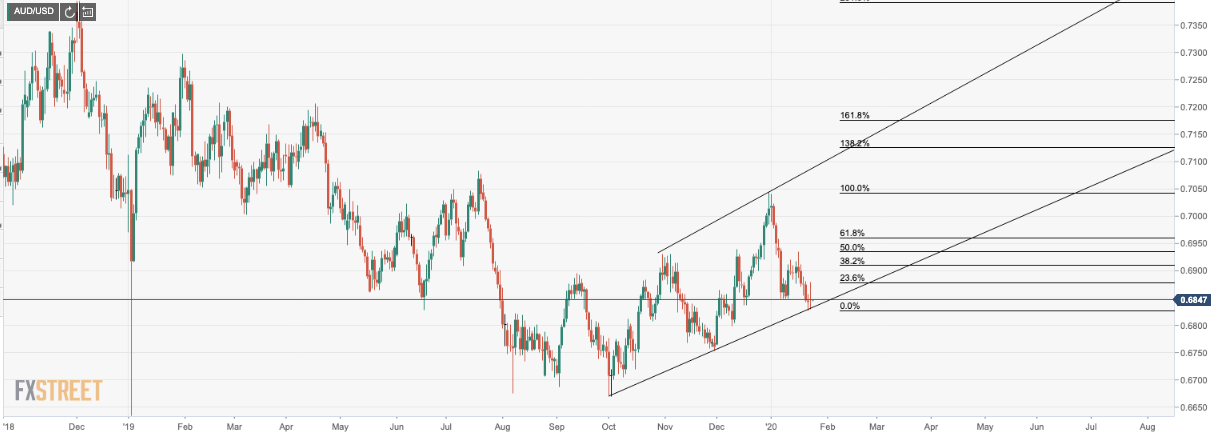

- AUD/USD bull channel intact and the resistances are well mapped out to target.

- Subsequent downside follow-through will open up the 61.8% Fibo.

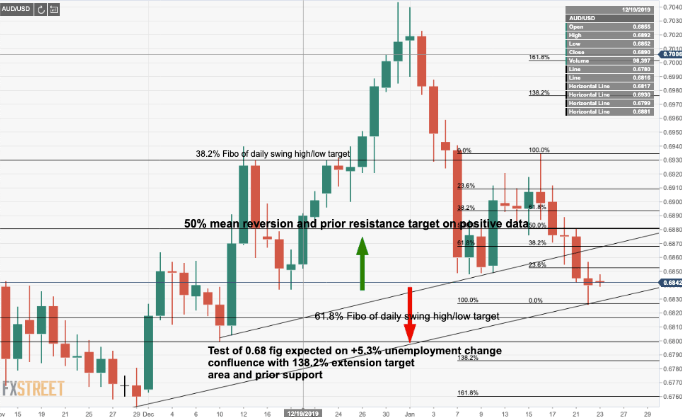

Following yesterday's jobs data and another improvement in the unemployment rate, the bulls are back in the picture, thrown a lifeline and some more time to bail out a sinking ship.

Looking to the charts, we can see that the bullish channel is still very much intact.

As per yesterday's analysis, the bulls can now look to a break of the prior resistance at 0.6880 and then a full reversal of the top of the RHS of the H&S which will put them in good stead for a continuation of the bullish trend.

On the flipside, as per yesterday's pre jobs data release, the bears can target the golden ratio as the 61.8% Fibonacci retracement target, 0.6820 area which will be expected to hold the initial tests. A subsequent break there will be game over the committed bulls and 0.66 will be on the cards. 0.6800 will give way to 0.6755 November low ahead of the target the 0.6671 October low