Back

7 Feb 2020

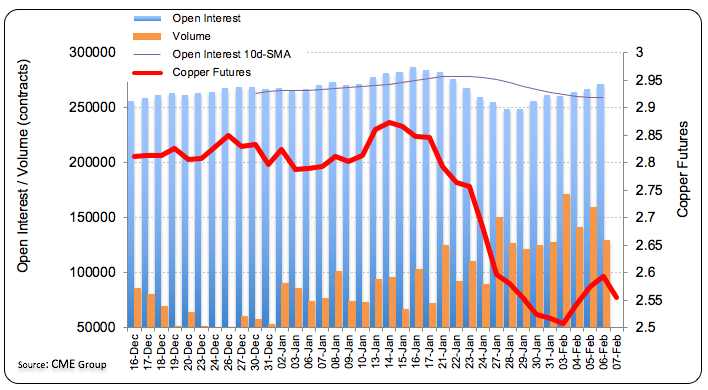

Copper Futures: Further correction appears likely

According to flash data from CME Group for Copper futures markets, open interest went up for the third consecutive session on Thursday, this time by nearly 4.4K contracts. On the opposite direction, volume extended the choppy activity and shrunk by around 27.8K contracts.

Copper: Recovery stalled ahead of Fibo retracement

The 3-day recovery in prices of the base metal seems to have met strong resistance in the proximity of the Fibo retracement of the January-February sell-off near 2.64 on Thursday. Rising open interest coupled with the failed attempt to extend the bounce leaves the scenario for some correction in the very near-term. In addition, the uptick in volume looks supportive of this view.