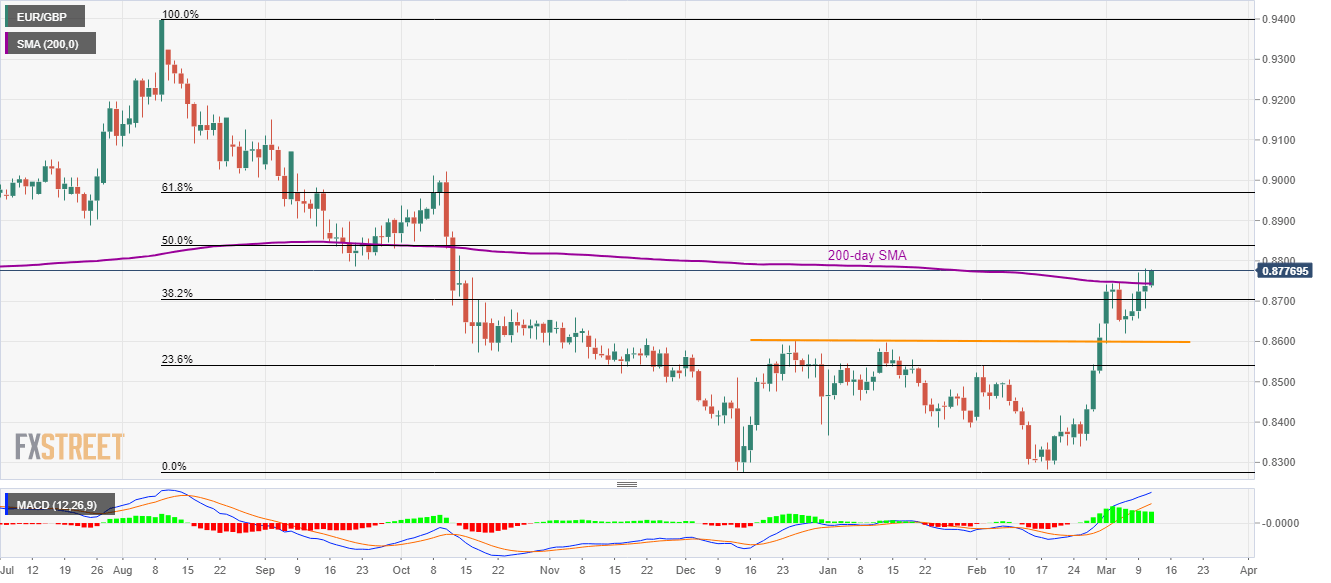

EUR/GBP Price Analysis: Pierces 200-day SMA in search of further upside

- EUR/GBP nears the highest level in five months, registers a five-day winning streak.

- 50% Fibonacci retracement can please buyers, a horizontal line from December-2019 limits short-term declines.

- Bullish MACD, sustained break of the key SMA favor buyers.

Having successfully breached 200-day SMA, EUR/GBP takes the bids to 0.8775, up 0.45%, ahead of the European open on Wednesday.

The pair currently heads to 50% Fibonacci retracement of its August-December 2019 fall, at 0.8837.

Though, 0.8900, 61.8% Fibonacci retracement level of 0.8970 and October 2019 high near 0.9030 can challenge buyers next.

Sellers can look for an entry in a case where the pair fails to stay beyond 200-day SMA, at 0.8745 now, on a daily closing basis, which in turn could recall 38.2% Fibonacci retracement and the recent lows, respectively around 0.8700 and 0.8620.

It should be noted that the pair’s declines past-0.8620 will find strong support around 0.8600 that comprises highs marked during December 2019 and January 2020.

EUR/GBP daily chart

Trend: Bullish