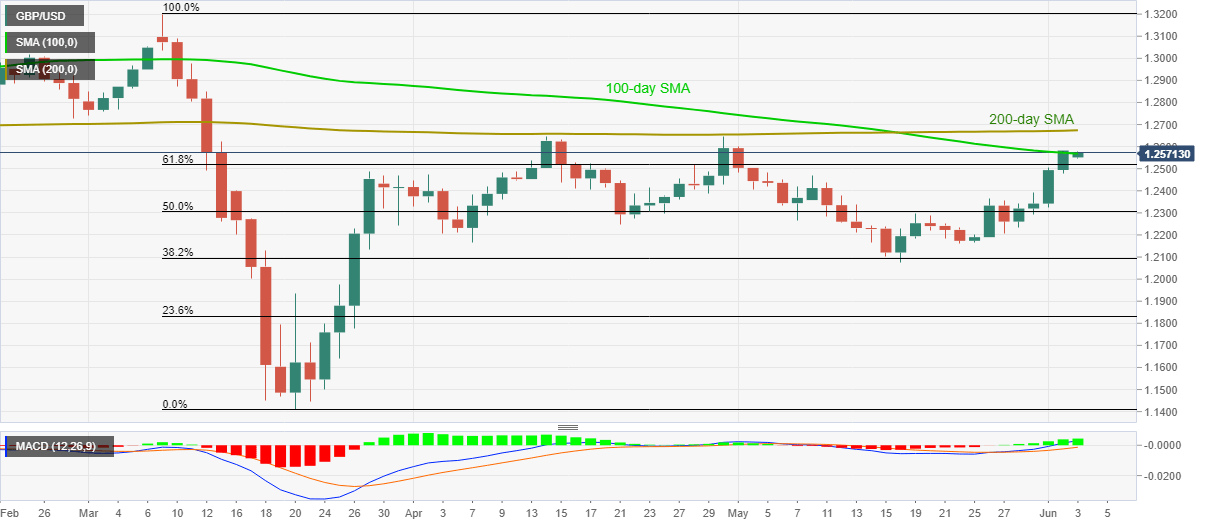

GBP/USD Price Analysis: Mildly positive above 1.2550, eyes 200-day SMA amid bullish MACD

- GBP/USD benefits from the Brexit, coronavirus headlines from the UK to rise to 1.2581.

- A clear break above 100-day SMA will aim for April top, 200-day SMA.

- Bullish MACD signals favors the buyers, sellers will look for entry below 61.8% Fibonacci retracement.

GBP/USD takes the bids to an intraday high of 1.2581 during the early Asian session on Wednesday. In doing so, the Cable surges to the highest since April 30 while cheering upbeat news about Brexit and the coronavirus (COVID-19).

Not only the European Union’s (EU) readiness to extend the Brexit by a period of two-year, UK PM Boris Johnson’s taking charge of the pandemic handling also propels the British Pound off-late.

In addition to the upbeat news, bullish MACD signals also favor the GBP/USD pair’s further upside.

Even so, bulls will wait for a clear break above 100-day SMA level of 1.2575 to probe April month high near 1.2650. However, a 200-day SMA level close to 1.2675 might question the bulls afterward.

On the downside, bears are less likely to enter unless the quote slips below 61.8% Fibonacci retracement of its March month fall, around 1.2520.

GBP/USD daily chart

Trend: Bullish