USD/INR Price News: Indian rupee rises towards 10-week-old resistance line

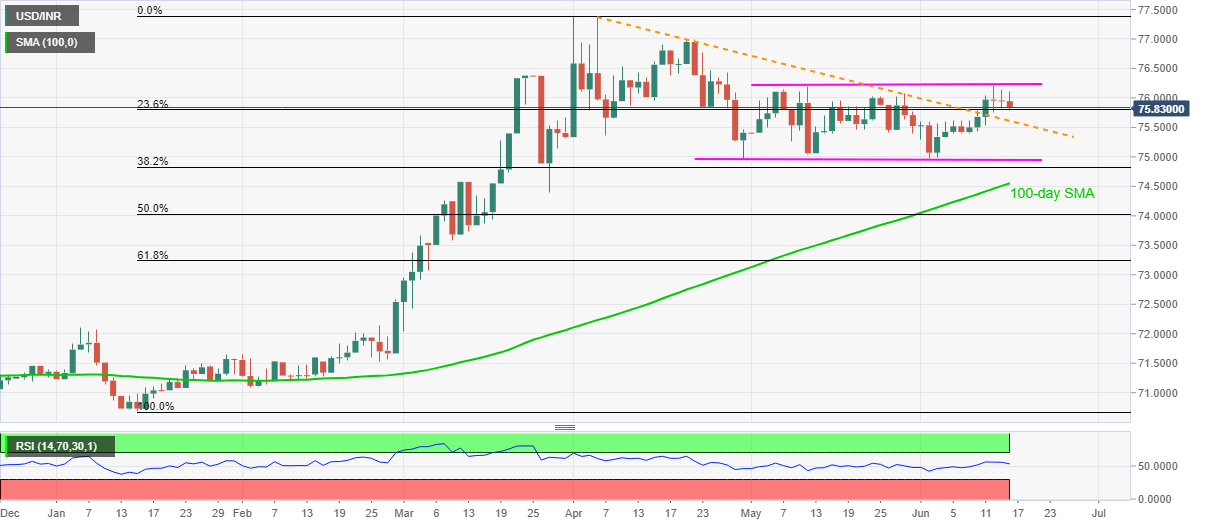

- USD/INR prints mild losses following Friday’s pullback from short-term trading range’s resistance.

- A resistance-turned-support line from April 06 gains sellers’ attention.

- 100-day SMA adds to the downside support, 77.00 offers additional upside barrier.

USD/INR declines to 75.83, down 0.15% on the day, during the pre-European session on Tuesday. The quote has been trading in a broad range between 76.22 and 74.95 since early-May. As a result, it’s the latest pullback from the upper limit suggests further declines.

That said, the short-term resistance-turned-support line around 75.61 offers immediate support to the pair ahead of 75.40 and the said range’s lower limit of 74.95.

In a case where the USD/INR prices decline below 74.95, a 100-day SMA level of 74.55 will offer additional support before dragging the pair towards March 11 low of 73.59.

Meanwhile, an upside clearance of 76.22 can aim for the late-March highs near 76.40 and April 22 top surrounding 77.00 during the further rise.

Though, a sustained break above 77.00 will enable the bulls to cross the April month high of 77.39.

USD/INR daily chart

Trend: Pullback expected