EUR/USD comes under pressure near 1.1250

- EUR/USD gives away initial gains and recedes to the 1.1250/60 band.

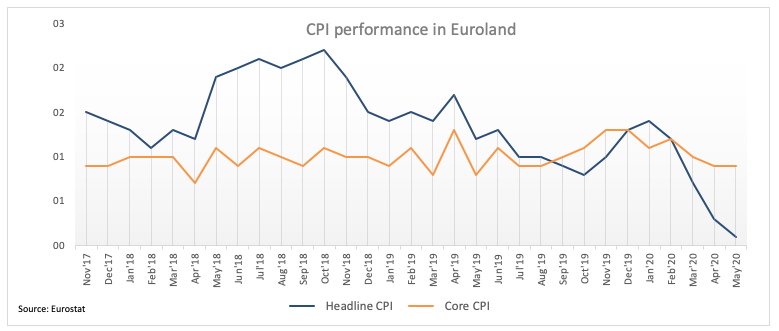

- EMU’s Core CPI rose 0.9% on a yearly basis during May.

- Housing data releases, second testimony by Fed’s Powell coming up next.

Following a test of daily peaks in the boundaries of the 1.1300 mark – where coincides the 100-hour SMA – EUR/USD met some selling pressure and is now slipping back to the 1.1260/50 band.

EUR/USD focused on USD, risk trends

EUR/USD is adding to Tuesday’s losses in the mid-1.1200s so far on Wednesday in spite of the steady performance surrounding the greenback in the wake of the opening bell in Euroland.

In fact, buyers returned to the greenback on Tuesday following reports of an outbreak of COVID-19 in Pekin, exacerbating the demand for the safe haven space.

Data wise in the euro area, Core CPI in the broader bloc rose at an annualized 0.9% during May, while headline CPI rose 0.1% over the last twelve months. Later in the NA session, housing data releases are next on tap seconded by MBA’s Mortgage Approvals, the speech by Cleveland Fed L.Mester (voter, hawkish) and the second testimony by Fed’s Jerome Powell.

At his first testimony on Tuesday, Chief Powell said the economic recovery faces rising uncertainty while he showed some confidence of a quick rebound in the labour market. Powell also stress that the Committee is still assessing the yield curve control issue.

What to look for around EUR

EUR/USD maintains the choppy fashion so far this week, with gains clearly limited around the 1.1350 region. In the meantime, price action continues to look to the gradual return to some sort of normality in economies of the Old Continent as well as some concerns regarding the probability of a second wave of coronavirus contagion. The constructive view in the euro, however, remains well sustained by the gradual and relentless re-opening of economies in Europe and by the ongoing monetary stimulus announced by the ECB, Germany and the European Commission. On top, the solid performance of the region’s current account is also adding to the attractiveness of the shared currency.

EUR/USD levels to watch

At the moment, the pair is losing 017% at 1.1243 and faces the next support at 1.1212 (weekly low Jun.12) seconded by 1.1186 (61.8% Fibo of the 2017-2018 rally) and finally 1.1025 (200-day SMA). On the other hand, a break above 1.1422 (weekly/monthly high Jun.10) would target 1.1448 (50% Fibo of the 2017-2018 rally) en route to 1.1495 (2020 high Mar.9).