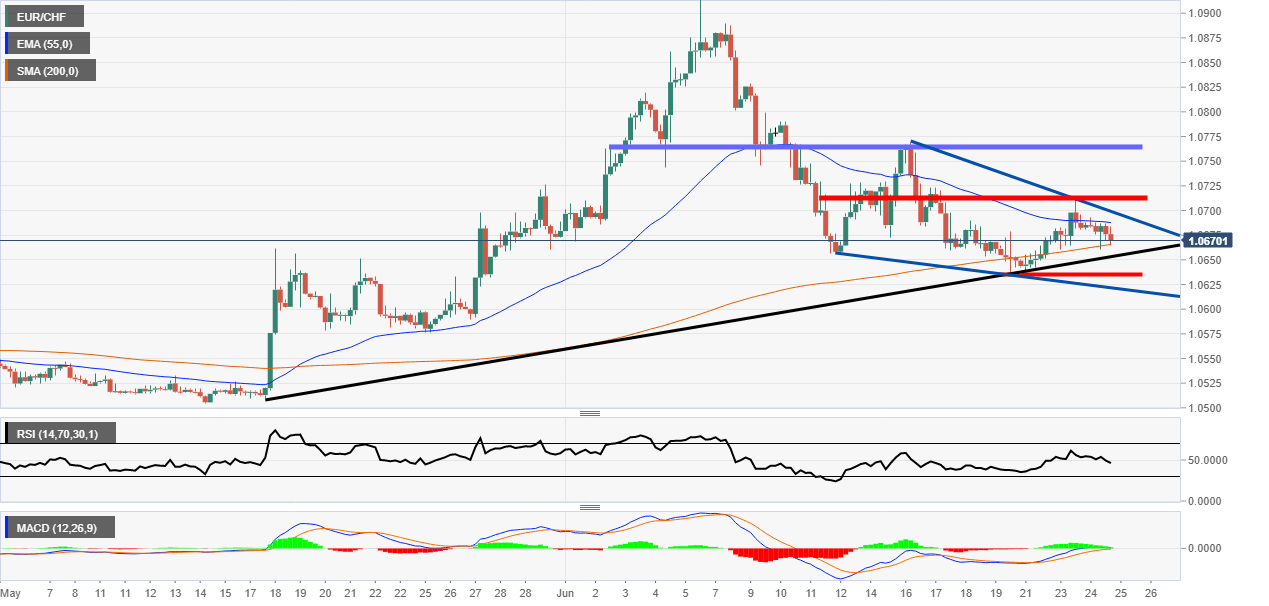

EUR/CHF could move further to the downside if the wedge pattern is broken

- EUR/CHF trades 0.15% lower as global risk appetite shifts lower.

- The price is also stuck between two key moving averages at the moment.

EUR/CHF 4-hour chart

EUR and CHF have both underperformed against the USD on Wednesday but CHF has held up better than most as it is a safe haven currency. In the battle of the safe-haven currencies CHF has even outperformed the JPY this session.

The pair is still not to close to the wave low at 1.0639 but if it does break then the trend might continue to the downside for the long haul. Right now the price is struggling between the 55 and 200 moving averages. A break in either direction could be pivotal in helping us work out the future trajectory of this pair.

On the bearish side, the MACD looks like the histogram might cross to the downside and the signal lines are already there which is already bearish signal. There is also a black upward sloping trendline on the chart and a break would add to the bearish checklist. Conversely on the upside, if the wedge pattern is broken then there could be a retest of the highs but at the moment it seems the more unlikely scenario.

Additional levels