GBP/JPY Price Analysis: Bulls eye 152.50 to mitigate imbalance

- GBP/JPy bulls are taking control and eye a breakout.

- The daily and weekly market structures offer prospects for 152.20 and then 153.20

GBP/JPY is moving higher in a phase of accumulation. The bulls can target the 61.8% ratio near 152.50 to mitigate the imbalance of the prior bearish impulse ahead of weekly resistance near 153.20.

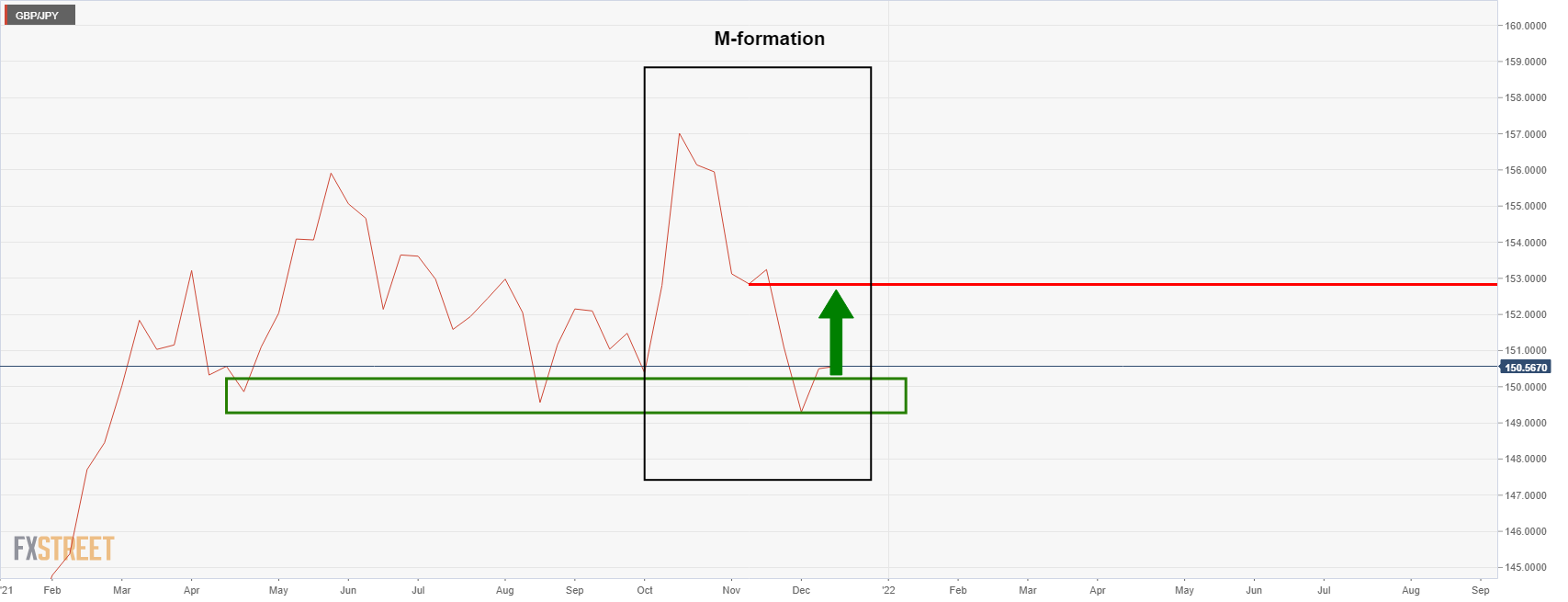

GBP/JPY weekly chart

The M-formation on the weekly chart is a reversion pattern that would be expected to pull in the bulls to the neckline located near 153.20. However, there is some work to do on the daily chart first with levels to break as follows.

GBP/JPY daily chart

From a daily perspective, support has been held and the bulls can home in on the 151.20s as per the order block eclipsed in the chart. A move towards the 61.8% golden ratio aligns particularly with the old support near 152.50. A break there opens risk to the M-formation's neckline, as illustrated in the weekly chart above.

A break of the daily support, however, opens the risk of a considerable move to the downside. 140/142.50 would be earmarked targets for the bears positioning for the downside in such a scenario, as per the following weekly chart: