USD/CHF Price Analysis: Bulls keep reins despite inaction around three-week-high near 0.9800

- USD/CHF remains sidelined near multi-day top, pausing five-day uptrend.

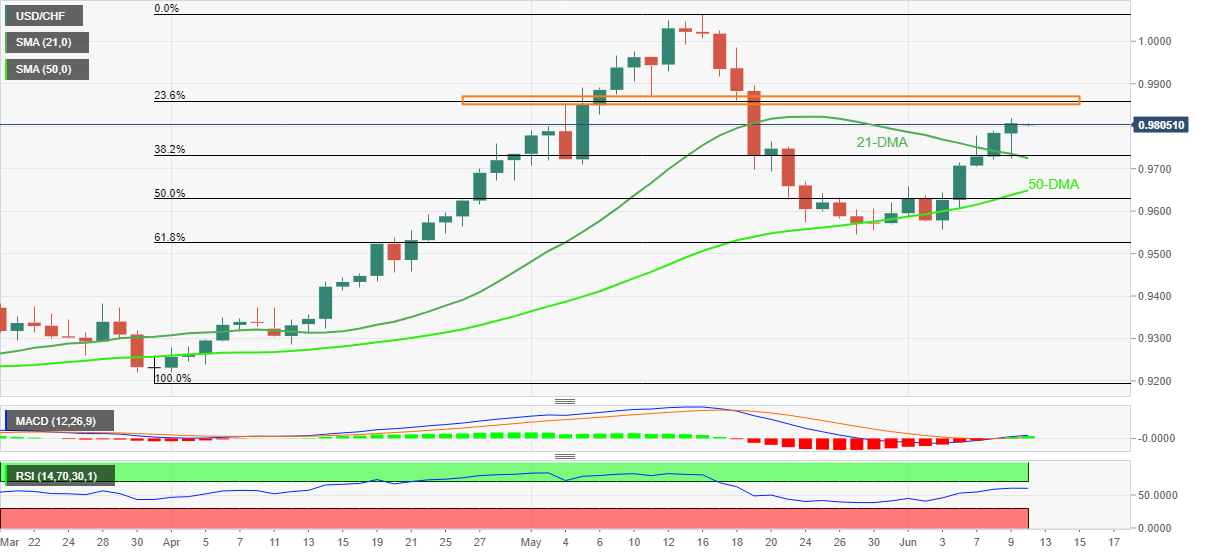

- Firmer MACD signals, RSI (14) joins successful break of 21-DMA to favor buyers.

- 50-DMA, May’s low act as the key support for bear’s conviction.

USD/CHF prices seesaw around 0.9800, after refreshing a three-week high during a five-day uptrend the previous day.

Even so, the Swiss currency (CHF) pair’s ability to stay beyond the 50-DMA and 21-DMA joins the recent bullish MACD signals, as well as firmer RSI (14), not overbought, to keep USD/CHF buyers hopeful.

That said, a five-week-old horizontal resistance area near 0.9855-75 appears a tough nut to crack for the USD/CHF bulls.

On the contrary, the 21-DMA and 50-DMA could restrict the quote’s immediate downside to around 0.9720 and 0.9650 respectively.

However, USD/CHF bears remain hopeful until the quote stays beyond May’s low of 0.9544.

Overall, USD/CHF has already signaled further upside but there is a little room on the north.

USD/CHF: Daily chart

Trend: Further upside expected