GBP/USD Price Analysis: 1.1890 and 1.2000 could be the decisive levels

- GBP/USD bulls are taking back control in late New York trade.

- The days ahead is bullish as per the current price action.

- Bears will need to commit to a break of 1.1890 to open downside risk.

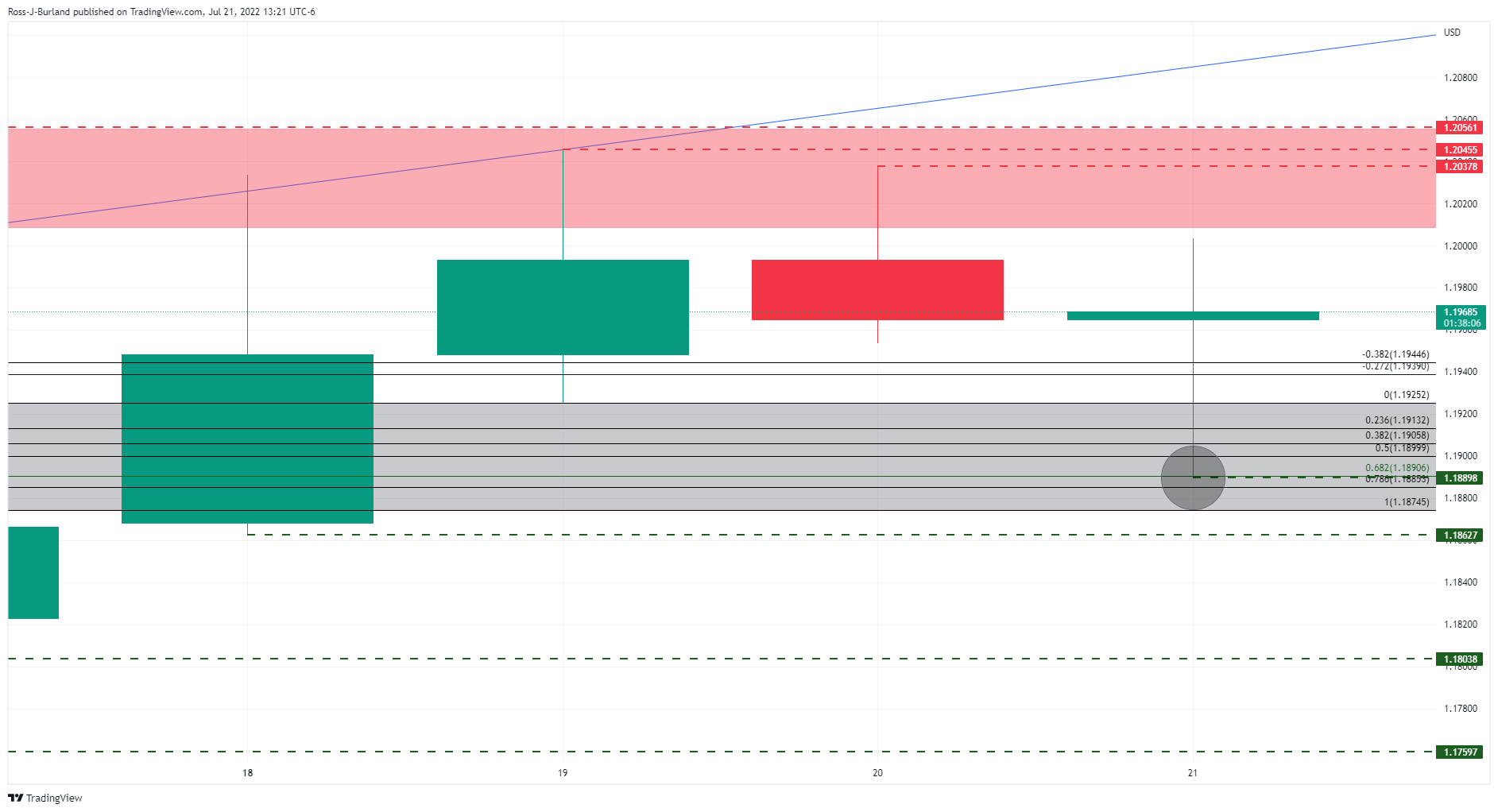

GBP/USD's broadening formations and current price action open the way towards the 1.2050s and beyond for the sessions ahead. A break of the round 1.2000 will be key in this regard.

GBP/USD daily chart, the bearish scenario

The daily chart's W-formation has played out with the price mitigating 61.8% of the inefficiency so far, grey area:

If the price were to continue lower, then the broadening formation would be expected to see cable extend into the low 1.17s in the days ahead. 1.1804 will be key in this regard ahead of 1.1760 as illustrated by the daily lows above.

GBP/USD daily chart, bullish scenario

Should the bulls commit at this juncture, on a break of the cluster of daily highs and resistance, then there will be prospects of a move towards the broadening formation's upper boundaries near 1.2220.

GBP/USD H1 chart, bullish scenario

The broadening formation and bullish price action on the hourly time frame open risk of a break of the recent highs to open the way for a move to the upper boundary of the broadening formation towards the 1.2050s and beyond for the sessions ahead. A break of the round 1.2000 will be key in this regard.